Shape your global wealth

with precision and confidence.

We are a private investment fund that allocates

capital to corner-stone of investment world:

S&P 500, commodities and bonds.

Meet Fibonacci Portfolio

Targeted Return

Risk-Reward Ratio

All-time max drawdown

Fibonacci Portfolio

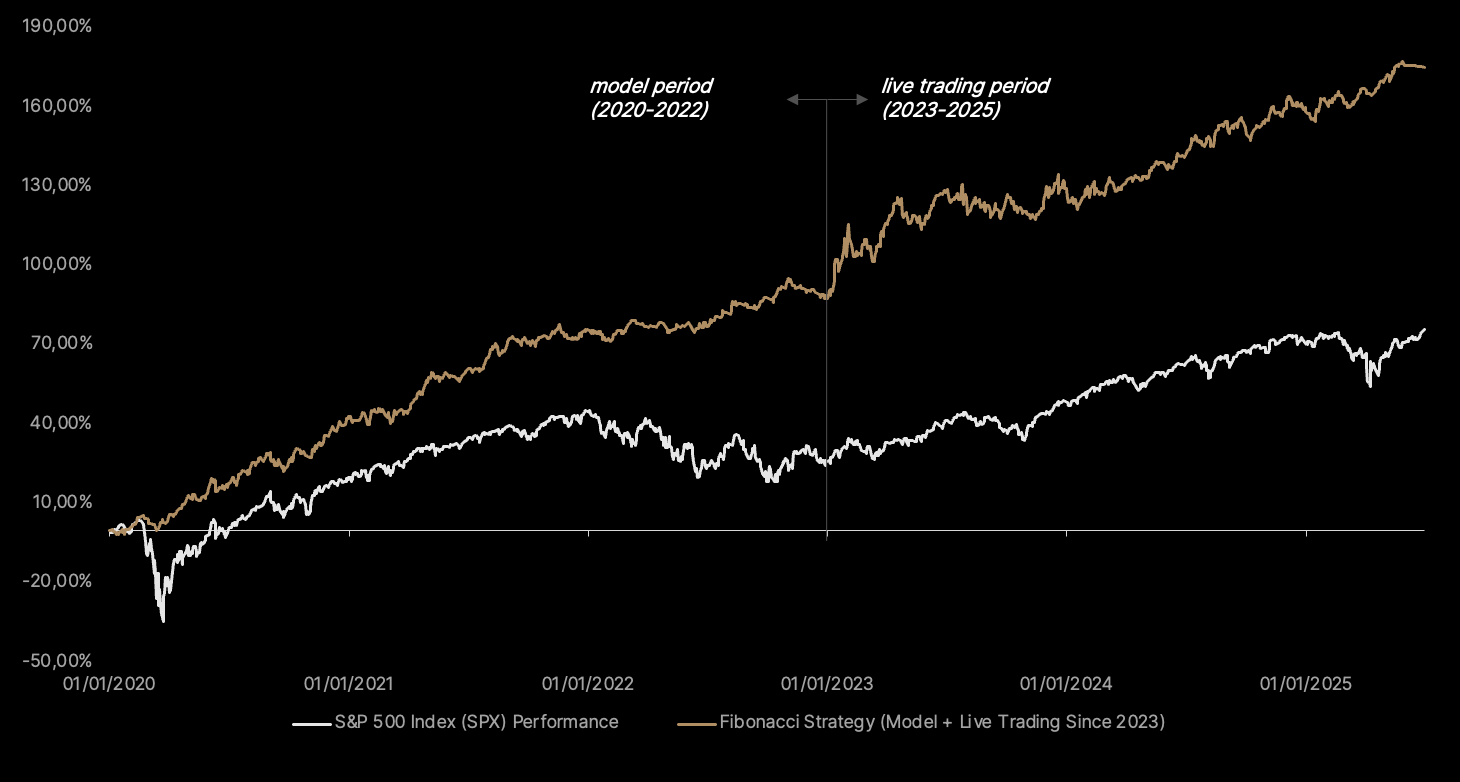

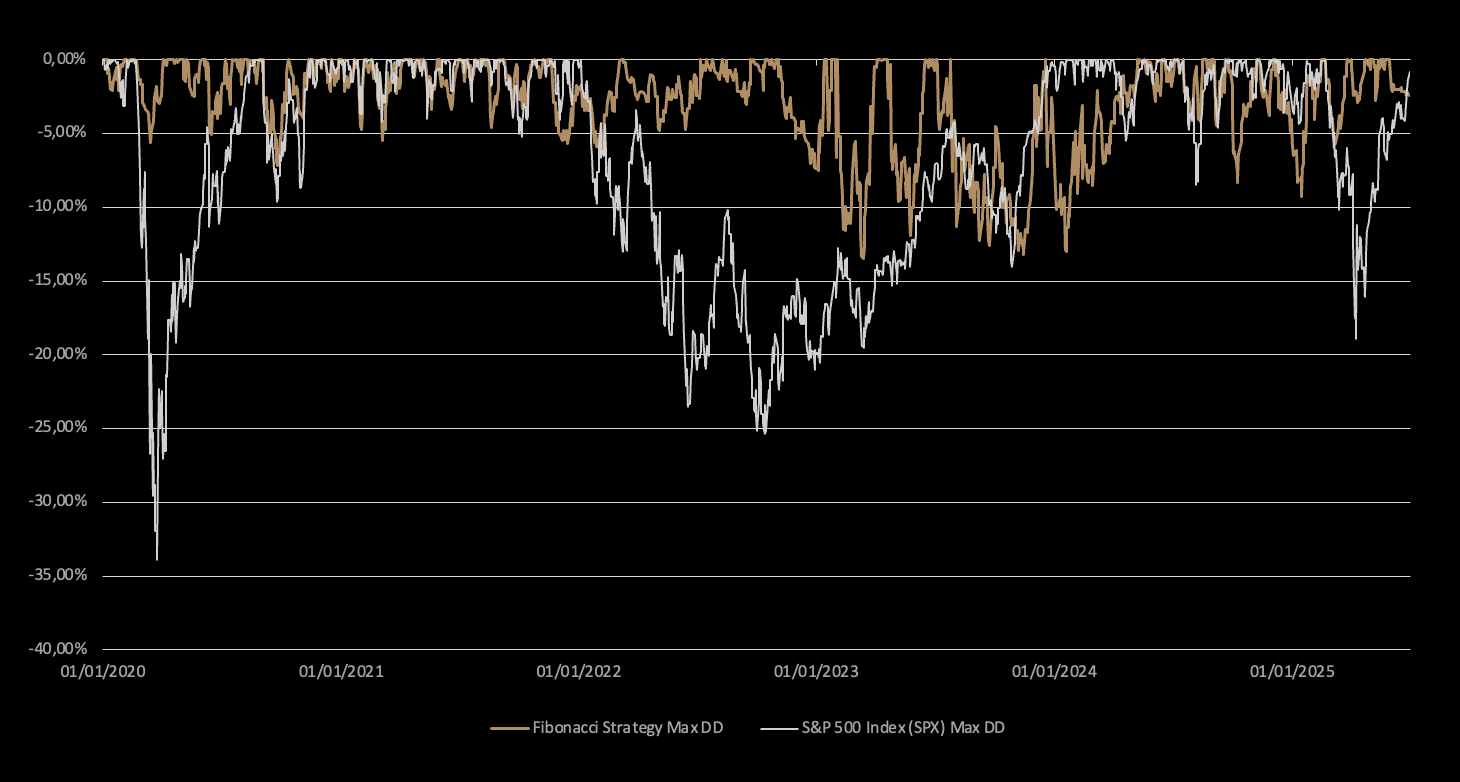

Fibonacci Portfolio is your response to global disruptions. In the face of recent challenges, cultivating a stoic mindset is key. Our strategy follows the same principle as Fibonacci sequence in nature. We deploy our flagship Fibonacci Core, which is centered on trading S&P 500 Index (SPX) options but is structurally uncorrelated with the index itself. In parallel, we apply a trendfollowing framework targeting indices, bonds, and commodities to capture directional market opportunities across asset classes. We prioritize risk mitigation while steadily growing your wealth brick by brick.

Fibonacci Portfolio: Combined Model and Live vs. S&P 500 Index (SPX) Performance

Fibonacci Potfolio

Annualized Return (2024)

Fibonacci Portfolio

Annualized Return (5 years average)

Fibonacci Portfolio

Maximum DD (all time)

Fibonacci Portfolio

Maximum DD (5 years average)

Sharpe ratio

1.31

Accounting Currency

EUR

Performance Fee

25% with high watermark on quarterly basis

Management Fee

1%

Fund type

open

Underlying Assets of the Fund

stocks, options, CFDs, futures

Broker

Interactive Brokers

Investment Horizon

5 years

Maximum Risk

matching SPX index

Minimum subscription

100,000€

Entry fee

2%

Exit fee

0%

Early Exit Fee

10%

Geographical Area

USA

Primary Exchanges

NYSE, NASDAQ

Locking Time

1 year

Calculation & Reporting

quarterly

Expected Investment Strategy Deployment

2 months

Strategy Framework

Our investment framework is built on two synergistic pillars: Core and Satellite. Together they aim to deliver consistent, risk-adjusted returns across all market environments.

Fibonacci Core

Fibonacci Satellite

We choose the right options based on quantitative analysis and current events on the financial market.

Bond & commodity trading does not correlate with stock market.

Non-stop position sizing based on quantitative analysis reduces risk of the highest drawdowns.

We increase profit additionally ranging from 2-15% with same drawdowns.

Consistent returns across all market cycles using a strategy uncorrelated with major equity indices.

Higher capital is needed to incorporate bond & commodity strategy.

Fibonacci Portfolio: Combined Model and Live vs. S&P 500 Index (SPX) Max Drawndowns

Values that drive our everyday decisions

Grounded approach

We are stoics. It is inevitable to slow down and sort out what has a long-term perspective to deliver results.

Decision mastery

We constantly develop our decision process. Our judgment proficiency is based on our quantum & technical analysis.

Embracing values

Practicing values is proof of a productive society. We are fully committed to crafting our fundamental analysis of companies and stocks we invest in.

What is softer than water?

Yet hard rocks are hollowed out by soft water?”